And actions taken by companies to sell their products internationally, protect against a multitude of financial and other risks, adjust to new technology and react to other developments often raise new accounting issues. CREEPING COMPLEXITY Regrettably, this level of complexity of generally accepted accounting principles has become more the norm than the exception. Although Statement no. 125 is very detailed, after it was issued many parties asked FASB to be even more specific about the accounting for securitizations and certain other common transactions, so the EITF developed several interpretations. FASB itself is in the process of amending the statement in certain respects, and a document has been recently issued by FASB staff covering numerous other implementation questions and answers. All of this is designed to help accountants apply the fairly basic concept in Statement no. 125 that assets are considered effectively sold when they are no longer controlled. Another noteworthy bulletin is ARB No. 45, which addressed the accounting for changes in accounting estimates.

How Liam Passed His CPA Exams by Tweaking His Study Process

The inception of Accounting Research Bulletins (ARBs) can be traced back to a period of economic upheaval and transformation. The Great Depression had exposed significant flaws in financial reporting, leading to a loss of investor confidence and a demand for more reliable and transparent accounting practices. In response, the American Institute of Accountants, now known as the American Institute of Certified Public Accountants (AICPA), established the Committee on Accounting Procedure (CAP) in 1939.

Publication Date

This could result in less-detailed statements if third- or fourth-level issues are not specifically addressed, as they are in many standards at present. It also could result in fewer pronouncements if those that dealt only with very narrow issues were not issued. Rather than accede to the many requests for answers to all possible situations, the FASB should ask itself whether more detail will result in better financial reporting. The answer could be a resounding no if the complexity of new accounting rules outpaced the ability of well-intentioned professional accountants to keep up with and understand them or discouraged appropriate professional judgment. One additional explanation FASB often cites for complicated standards is that corporations lobby aggressively for desired financial reporting outcomes, such as smoothing the effects of transactions on periodic net income.

- ARBs were pioneering in their time, providing much-needed guidance in an era of fragmented practices.

- This was particularly important in an era when the lack of standardized practices often led to significant discrepancies in financial reporting, making it difficult for stakeholders to make informed decisions.

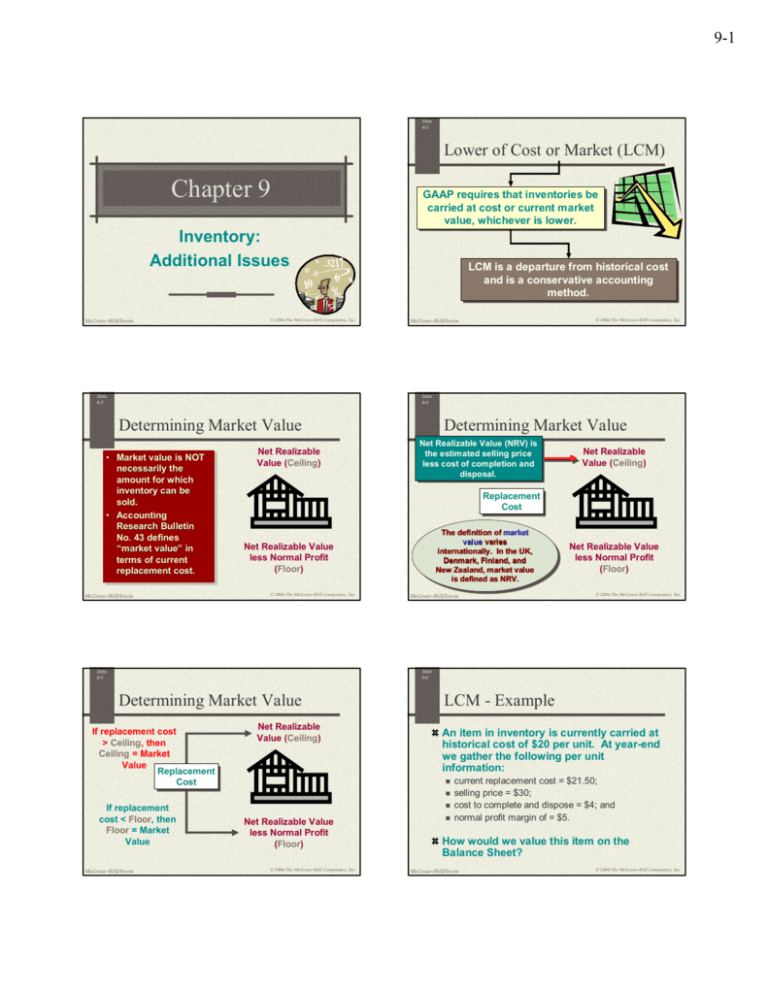

- It emphasized that the primary basis of accounting for inventory is cost, which is defined as the sum of the applicable expenditures and charges directly or indirectly incurred in bringing an article to its existing condition and location.

- However, accountants must carefully read and understand all 245 pages to ensure that the statement is adopted properly, a formidable challenge even for those relatively few accountants with a good understanding of derivatives.

Group Depreciation: Concepts, Calculations, and Financial Impacts

The ARBs were influential in shaping the development of accounting principles in the U.S. during that time. The evolution from Accounting Research Bulletins to contemporary standards highlights a remarkable journey of increasing sophistication and precision in financial reporting. ARBs were pioneering in their time, providing much-needed guidance in an era of fragmented practices. The issuance of Accounting Research Bulletins marked a significant step towards the standardization of accounting practices, but the journey did not end there. As the business environment continued to evolve, so too did the need for more robust and comprehensive accounting standards.

BALANCING STANDARDS AND JUDGMENT Professional judgment and common sense augmented by analogies to other standards can guide the accounting for many new accounting issues. Most parties agree that financial reporting is not useful unless there is a reasonable degree of comparability from company to company. Readers cannot place much credibility in financial statements if, for example, one company decides that an expenditure qualifies as an asset and another company decides that the same expenditure is a current period expense. However, almost all accounting rules require some degree of professional judgment in their application. The challenge to standards setters is to provide enough specifics to ensure parallel application without going overboard on detail.

Accounting standards setters, encouraged by questions from auditors, company representatives and the SEC, consequently are tempted to go overboard and pursue uniformity past the point of diminishing returns. The result is rules that only a specialist can interpret and accounting that may lose sight of the objective of meaningful reporting. In fact, many parties suggest that detailed rules only encourage loophole identification followed by even more rules.

The bulletins were issued during the 1939 to 1959 time period, and were an early effort to rationalize the general practice of accounting as it existed at that time. Some of these issuances dealt with topics that were highly specific to the era, such as Accounting for Special Reserves Arising Out of the War (ARB 13) and Renegotiation of War Contracts (ARB 15). In total, 51 ARBs were issued, covering topics such as revenue recognition, depreciation, inventory valuation, consolidations, and contingencies, among others. However, the ARBs were criticized for being based on individual cases and lacking a coherent framework or a set of underlying principles. One of the most significant advancements in modern standards is the emphasis on a conceptual framework.

Refers to AU 150 (replaced by AU-C 200), a specific section of AICPA’s Codification of Statements on Auditing Standards.You can find a copy of AU 150 on the PCAOB site.

ARB No. 43 is particularly noteworthy because it served as a comprehensive restatement and revision of the previously issued ARBs, consolidating and updating the guidance contained in those bulletins. In 1959, the AICPA replaced the Committee on Accounting Procedure with the Accounting Principles Board (APB), which took over the role of setting accounting standards in the United States. The CAP was replaced by the Accounting Principles Board, which in turn was later replaced by the Financial Accounting Standards Board (FASB). The FASB continues to issue accounting standards on a variety of topics, most of which are aligned with the standards issued by the International Accounting Standards Board (IASB). Accounting Research Bulletins are issuances of the Committee on Accounting Procedure (CAP), which was part of the American Institute of Certified Public Accountants (AICPA).

If such all-in-one-place guidance were put together, FASB or other groups doing the job might even find that there are quite a few standards that have outlived their usefulness and can be eliminated. SIMPLICITY AS A STRATEGY In 1992 FASB preliminarily addressed many of the concerns of constituents through a three S program—for selectivity, speed and simplicity. The rise of digital reporting and data analytics has necessitated more detailed and granular standards to ensure accuracy and transparency. For instance, the adoption of the Extensible Business Reporting Language (XBRL) has revolutionized how financial data is reported and analyzed, enabling real-time access and comparability across different jurisdictions.

The International Accounting Standards Board (IASB), established in 2001, has been instrumental in promoting global convergence of accounting standards. The IASB’s International Financial Reporting Standards (IFRS) have been adopted by accounting research bulletin no 43 over 140 countries, reflecting a commitment to a unified set of high-quality accounting standards. The foundational work of ARBs, with their emphasis on consistency and comparability, can be seen in the principles underlying IFRS.